Bitcoin Gold (BTG) — history, principle of operation, advantages and disadvantages

11.04.2022 | mnalilovich

In the history of cryptocurrency, since Satoshi Nakamoto presented his white paper, it was [bitcoin] (/blog/en/cryptocurrency/bitcoin/) that became the most cloned distributed registry that survived many forks. One of the most successful, without a doubt, was Bitcoin Cash, which is consistently among the ten largest in terms of capitalization of unsecured digital assets. However, another implementation of the bitcoin blockchain principle, which took its place of honor in the hundred capitalization and gained popularity of the community, became Bitcoin Gold.

The history of Bitcoin Gold

Bitcoin Gold was officially introduced to the world in 2017. The founding father is considered to be Jack Liao, the creator of Lightning ASIC and the owner of one of the largest mining farms, which until recently was located in Hong Kong.

As closely connected with the field of mining and the production of bitcoin mining equipment, Jack Liao was aware of the complexity of maintaining the operability of the first cryptocurrency network, and most importantly, the threat associated with the concentration of crypto mining in the hands of large companies, which made it almost impossible for small enterprises and individuals to enter the industry. This posed a threat to one of the main advantages of cryptocurrencies — decentralization.

The solution was the emergence of a new cryptocurrency designed to improve the digital gold protocol and simplify the mining process — Bitcoin Gold. This is why a cryptographic algorithm for building a distributed registry based on Equihash was chosen. This allowed the owners of farms on video cards to take part in the mining process, which, in turn, delayed the conquest by large corporations of control over the blockchain of popular cryptocurrencies.

The launch process itself took place by dividing the main branch of the distributed bitcoin registry on block 491 407. In fact, Bitcoin Gold began its work on October 25, 2017, and fully earned in November. Due to the peculiarities of the creation of forks, everyone who owned digital gold coins on November 1, 2021, was able to receive coins and new cryptocurrencies.

Features of the Bitcoin Gold Distributed Registry

Bitcoin gold uses the Proof of Work consensus algorithm , however, as already mentioned, it was decided to change the cryptographic algorithm to the popular Equihash. Thus, the process of maintaining the network operability and mining new coins became unavailable on specialized equipment — ASIC, and each owner of video cards could contribute and receive part of the reward.

Otherwise, Bitcoin Gold is similar to its parent. Also, the maximum issue is 21,000,000 coins, and it takes 10 minutes to create one block. As in Bitcoin, during the mining process, over time, the reward for each block extracted will be halved, and miners will receive remuneration in the future only from commissions for transfers.

Advantages and Disadvantages of Bitcoin Gold

Disadvantages of Bitcoin Gold, for the most part, inherited from its parent and cryptocurrencies in general. In this it is similar to other projects. But the advantages should be mentioned separately:

- an improved code base, which is more resistant to hacking,

- a new algorithm allows you to increase decentralization.

Useful links

Project website: https://bitcoingold.org/

Online exchange: Cryptex

Online wallets:

Mobile wallets:

- [Coinomi] (https://play.google.com/store/apps/details?id=com.coinomi.wallet&hl=ru)

- [Bitpie] (https://bitpie.com/#/)

Anonymous purchase and sale of Bitcoin Cash for cash

Anonymous purchase and sale of Bitcoin Cash on the Cryptex cryptocurrency exchange is available 24/7. To make a transaction, you need to register in the system and deposit your account in any convenient way.

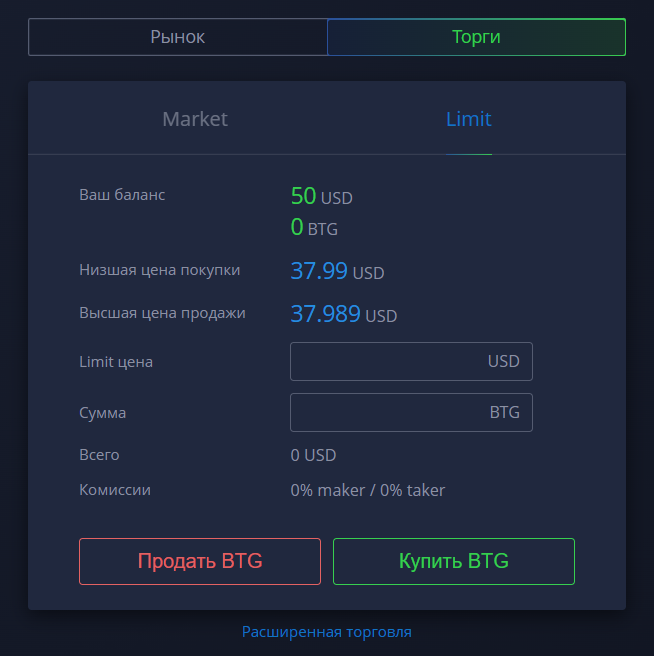

Transactions with Bitcoin Gold on the Cryptex exchange

All transactions for the direct exchange of Bitcoin Gold for cash and back take place on the corresponding page of the trading pair BTG/USD after authorization on the platform.

To buy or sell, you need to fill in two fields:

- Limit price — the price at which the user is ready to sell or buy Bitcoin Gold.

- Amount — the volume of the operation performed.

After filling in, depending on the planned direction of the exchange, to complete the creation of the order, you need to click the corresponding “sell” or “buy” button.

If there is already a counter offer on the exchange with the appropriate price and sufficient volume, the order will be closed automatically. If the transaction does not go through completely, or there will be no counter offer at a similar price at all, then the created order will fall into the general order book of the exchange, where it will be placed until the counteroffer appears or is canceled by the user himself.

If it is planned to conduct transactions for a large amount that can affect the prices on the online cryptocurrency exchange, then it is better for the user to use OTC transaction. Thus, it is possible not only to get the most attractive fixed price for a large volume, but also to ensure a quick exchange in the chosen direction.